IRS Form 8962 Printable: Instructions & Tips

Filing IRS Form 8962 can save you some money you spend on your Health Plan. If your family fits the requirements, and you have spent any money on Marketplace health insurance premiums, you can claim your Premium Tax Credit for that reason. So, if your claims are accepted, you can either pay fewer taxes or get greater refunds. Let’s find out how to fill out form 8962.

The 8962 Form is one of the simplest. It only has two pages, as you can see from the Form 8962 printable template. Even its official instruction has 20 pages, and, besides that, the most important reminders are printed on the form itself.

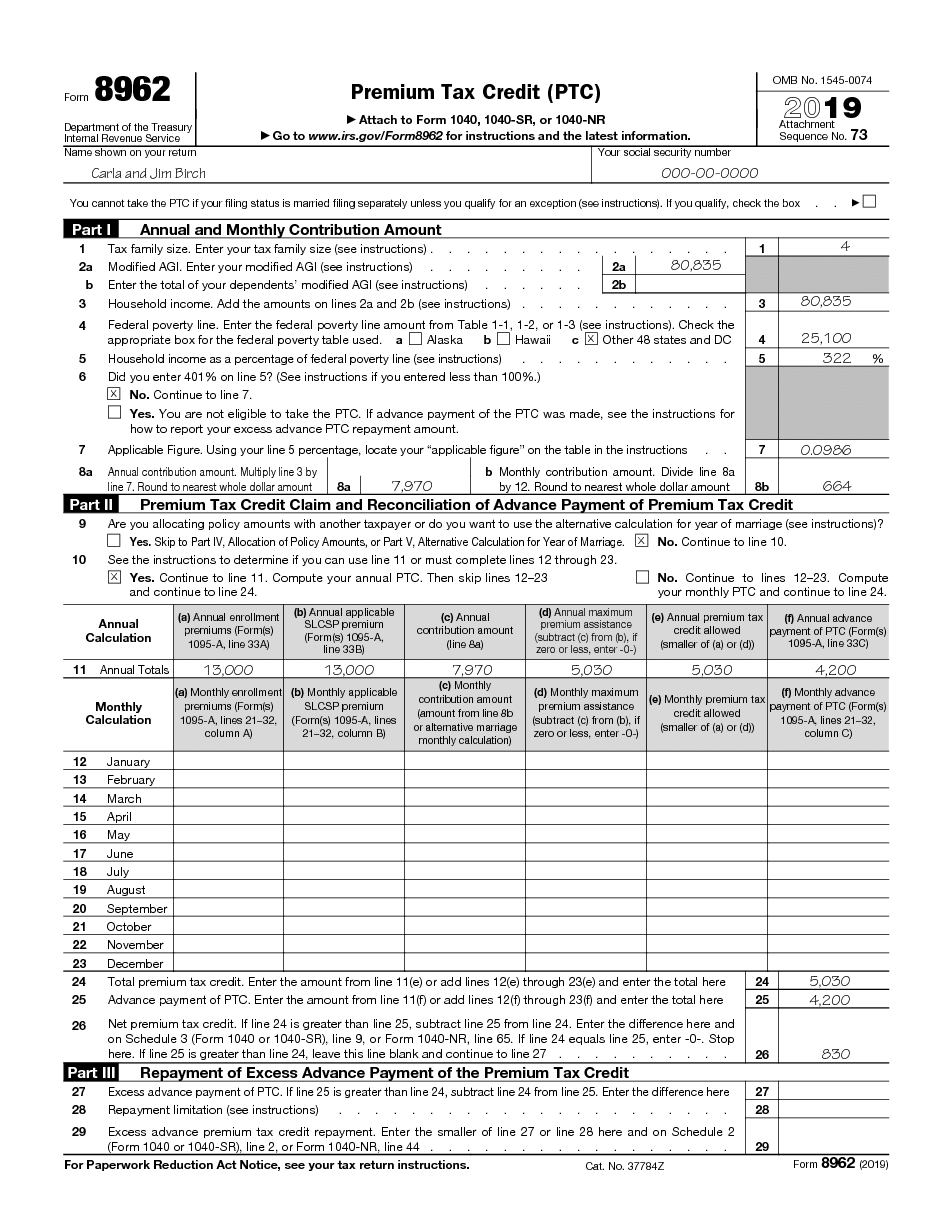

The first page of the blank Form 8962 seems quite obvious to file, though there are some tricks. It requires you to note the size of your tax family, the total taxable income, and some the calculation. If you download and print Form 8962 to have it before your eyes, some say, it will become easier to comprehend.

The most sophisticated part of it is the calculation. It requires a look at your 1095-A form you have filed when getting your Marketplace Premium plan. You probably took care to spare yourself a copy of that. In the 8962, there are directions which figure which data from 1095-A you need to copy to your calculations in 8962.

If there is a reference to, say, like 8a with no specification of the form, the form in question is that very form you’re filling now. For example, Annual Contribution amount from line 8a should be just repeated in line 11c (where it’s directly mentioned). Luckily, you have your form 8962 printable template, so if you unwillingly make a mistake, you can just print yourself another copy.

As for the second page of the tax form 8962, the trickiest part of it is allocations. There are fields for four allocations you must file if there are any. Allocation means sharing a Premium plan with someone who is not a part of your tax family. This can be a plan shared by another taxpayer and your family member, or you and someone from outside your family who is not a taxpayer, or any situation of that sort. For any allocation, you must enter the percentage of participation of the allocated person in the monthly amounts, and also the period when this allocation was taking place.

The 8962 Form is one of the simplest. It only has two pages, as you can see from the Form 8962 printable template. Even its official instruction has 20 pages, and, besides that, the most important reminders are printed on the form itself.

The first page of the blank Form 8962 seems quite obvious to file, though there are some tricks. It requires you to note the size of your tax family, the total taxable income, and some the calculation. If you download and print Form 8962 to have it before your eyes, some say, it will become easier to comprehend.

The most sophisticated part of it is the calculation. It requires a look at your 1095-A form you have filed when getting your Marketplace Premium plan. You probably took care to spare yourself a copy of that. In the 8962, there are directions which figure which data from 1095-A you need to copy to your calculations in 8962.

If there is a reference to, say, like 8a with no specification of the form, the form in question is that very form you’re filling now. For example, Annual Contribution amount from line 8a should be just repeated in line 11c (where it’s directly mentioned). Luckily, you have your form 8962 printable template, so if you unwillingly make a mistake, you can just print yourself another copy.

As for the second page of the tax form 8962, the trickiest part of it is allocations. There are fields for four allocations you must file if there are any. Allocation means sharing a Premium plan with someone who is not a part of your tax family. This can be a plan shared by another taxpayer and your family member, or you and someone from outside your family who is not a taxpayer, or any situation of that sort. For any allocation, you must enter the percentage of participation of the allocated person in the monthly amounts, and also the period when this allocation was taking place.

Latest Articles

How Do I Learn the Federal Poverty Line? How to Fill Out the 8962 Form?

It’s not the case to answer “just google it”. The data you should consider is printed in the instruction that comes along with the Form 8962 printable. The instruction contains three poverty line tables, for Alaska, Hawaii, and the 48 Contiguous states and the DC. The figures depend on the size of your tax family. If the poverty line is reviewed, the IRS has to update the instruction, and the new one will be available on our website as soon as it happens.

September 14, 2020

Is the Printable 8962 A Valid Form to File? How to Complete Form 8962?

Yes, you can print the form you download from our website, as it’s the one established by the IRS. As you see, it’s all colored black. If a printable form is published for informational purposes only, some of its sections are colored red. These forms are only to be used as drafts; valid scannable ones need to be ordered separately. But Form 8962 printable PDF is all black, and so you can print it and file. Just watch the year preprinted in it: each year, it’s updated.

September 07, 2020

Is 8962 Updated Yearly? Where Do I Get Form 8962 Examples?

Yes. There is the current year preprinted in the top right corner of the first page. If you have saved multiple files on your computer, open them and look at the year in that corner, so you can see whether the form is valid for this year or not. It’s also advisable to have an IRS form 8962 instructions file. If you filled out the form during one of the previous years, it’ll make an example of form 8962 filled out. As for the current form, it’s easier to download the print 8962 form 2020 from 8962form-printable.com, where it’s always up to date.

August 27, 2020

How to fill form 8962 online

The standard IRS form 8962 for 2020 contains four fields for allocations, but there may be more (for example, when it’s an interaction between families with many children). If that’s the case, and four allocations aren’t enough, you can read the instruction on expanding the form.

The alternative calculation for the year of marriage is applied if you got married during the year, and in your family, an APTC was paid for an individual. In fact, this excludes your current spouse from the tax family for the part of the year before the marriage. This way, your family before the marriage is considered as a smaller one, and thus you can save some tax to pay or get more refund. Read the instructions for 8962 tax form to get more details on this.

The alternative calculation for the year of marriage is applied if you got married during the year, and in your family, an APTC was paid for an individual. In fact, this excludes your current spouse from the tax family for the part of the year before the marriage. This way, your family before the marriage is considered as a smaller one, and thus you can save some tax to pay or get more refund. Read the instructions for 8962 tax form to get more details on this.

8962 Form Instructions

IRS Form 8962 Questions

What is your main questions about Form 8962?

Enter Cabinet

Enter Cabinet Find Documentation

Find Documentation